Performance

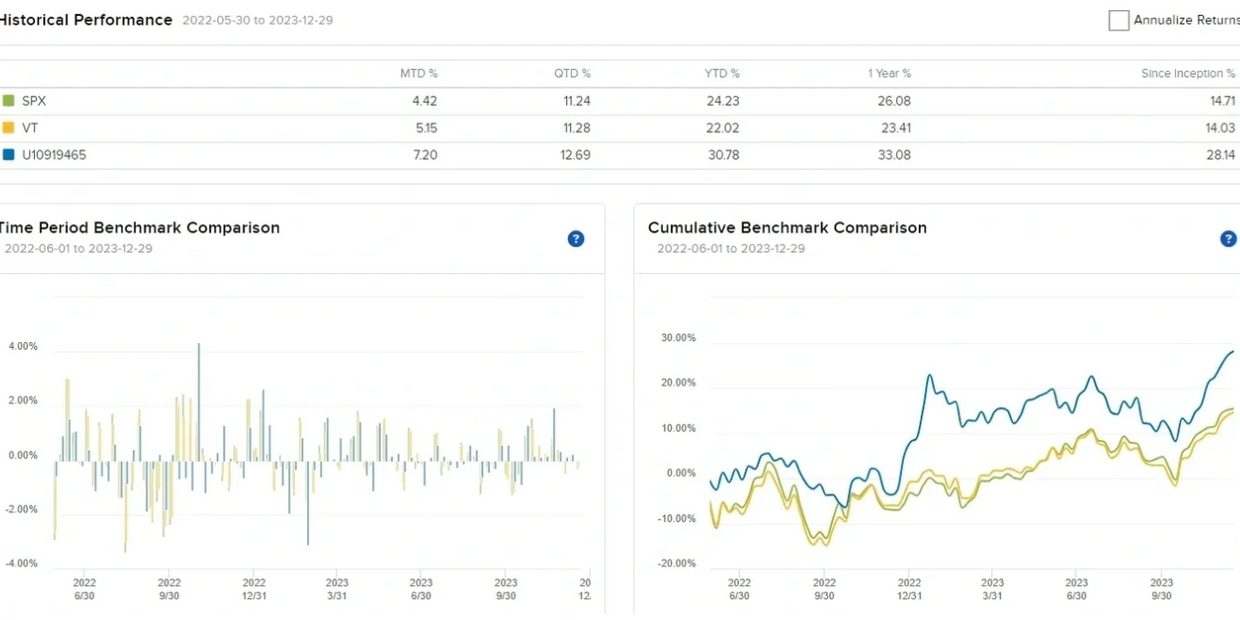

Performance since inception on June 1st, 2022, until the end of 2023

While many players in the financial world like to puff themselves up using fancy terminology and inflated concepts, they can rarely back up their "knowledge" with performance. I believe that long-term performance is the only viable measure of knowledge and competence in the world of investing. While the period since the inception of my portfolio is too short to draw final conclusions, I hope it is an indication of my skill.

While it doesn´t make sense to look at performance vs. benchmarks in the short run, it does so in the long run. If you can´t outperform an index fund through stock picking over a reasonable time span, you should consider investing in an index fund. As a benchmark, I chose the S&P 500 (SPX) since it is one of the best-performing index funds worldwide and the Vanguard Total World Stock Index Fund (VT) because it represents the performance of the average global stock market.

Want to learn more?

Feel free to reach out. I am happy to get in touch and help to improve your results!

Copyright © 2024 Marea Value Funds - All Rights Reserved.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.